New Zealand has a tax system that generally does not tax capital gains. However, there are exceptions to this rule and certain types of capital gains are taxed. The Bright-Line test, which imposes tax on gains made on the sale of real estate is an example of such an exception.

The Bright-Line test was introduced in October 2015. The enactment of this rule captures profits gained by property investors who acquire residential properties and resell the property within a 2-years period. The test period starts on the date of transfer of the title in the property to the seller and ends on the date when the seller signs a contract to sell the property.

The Bright-Line test captures the gain equivalent to the difference between the sale price on sale of the property and the costs of acquisition of the property. Capital gains generated by this form of investment are taxable at the taxpayer’s highest personal marginal tax rate. This means that if a taxpayer, who earns an annual income of $100,000 per annum from salaried work, sells a property at a total capital gain of $300,000, the taxpayer will be taxed for the capital gain of $80,000 at 33% and at 39% for the balance of the capital gain of $200,000.

The Bright-Line test was introduced to support the current intention-based property acquisition test where one’s intention at time of acquisition determines whether the capital gain is taxable at time of sale of the property. The intention test is a subjective test and more time-consuming to determine, whereas with the Bright-Line test, intention is not relevant and is a straight forward test to implement.

Main homes, relationship properties and inherited properties are exempted from the Bright-Line test. This is because this test targets property investors who purchase residential properties and resell after the purchase to profit from the capital gain. The test treats such purchases as done solely for the purpose of generating profits through capital gains. The three types of exemptions serve to protect residential property owners who do not engage in for profit investment dealings against the effect of the capital gains tax.

In 2018 the Bright-Line test was amended such that the Bright-Line test captures sale of a property within 5 years from time of acquisition of the property. This came into effect on 29 March 2018.

On 27 March 2021, the Bright-Line test period was further extended from sale within 5 years to sale within ten years. This means that if a property is purchased after that time, capital gain is payable on the sale of the property if the property is sold within 10 years of purchase except where the property is a “new build”.

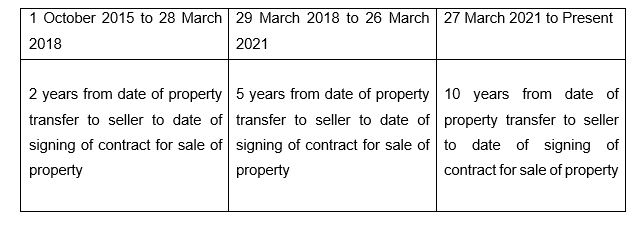

The application of the Bright-Line test and the periods it applies to is summarised in the table below.

Bright-Line Test Periods

To encourage the building of more residential properties, an exemption was allowed for sale of a “new build” property. If a residential property is classified as a new build, instead of the new extended 10-year rule, the 5-year bright-line test continues to apply. To qualify as a new build:

In all cases to qualify as a “new build” for purposes of the Bright Line test, the dwelling must be a self-contained dwelling and must still be on the land when it is sold for the Bright-Line period of 5 years to apply.

The purpose behind this exemption is to encourage investments in new builds to increase housing supply in New Zealand, while disincentivising investment in existing homes that would effectively increase house prices.

Offshore persons are also impacted by the Bright-Line test through the Residential Land Withholding Tax legislative scheme provided in the Income Tax Act 2007. If an offshore person who acquired residential land after 26 March 2021 sells the land within 10 years of purchase of the property, the lesser of 33% of the seller’s gain (namely difference between price of acquisition and sale price) and 10% of the gross sale price will have to be withheld by the seller’s lawyer and paid to Inland Revenue.

The above information is intended to provide general information. The contents contained in this article do not constitute legal advice and should not be relied on as legal advice.